Effective Duty Mitigation Strategies

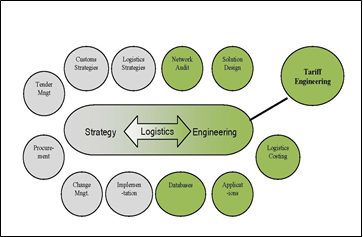

In its simplest terms, tariff engineering means an importer is allowed to make a product in a way that the lowest possible duty rate applies at time of importation.

While tariff engineering doesn’t do much for importers of finished goods, those importing semi-finished goods as inputs to finished products, tariff engineering could provide an advantage.

U.S. laws provide a framework for how to import goods. It is important that importers speak with their overseas vendors, customs broker and/or attorney to determine the most cost-effective way of manufacturing the product to save on import duties – i.e., tariff engineering. The earlier this is done in the production process, the more predictable it will be on how Customs will react.

The above definition of ‘Tariff Engineering’ was handed down in a U.S. Supreme Court holding from a case in the 1800s that still holds true today; my law professor would say that this is still “good law.” However, in situations where there are questions regarding the correct tariff classification, importers should keep in mind that even if their conclusion is accepted by Customs, it may be challenged by domestic parties. Therefore importers should make sure to have complete back-up documentation supporting their chosen classification and should review with an expert prior to requesting a Customs ruling.

An alternative would be to import semi-manufactured goods into a Foreign Trade Zone. Foreign Trade Zones (FTZ) are secure areas under U.S. Customs supervision. Located in or near Customs ports of entry, they are the United States’ version of what are known internationally as free-trade zones.

Customs duty and federal excise taxes, if applicable, are paid when the merchandise is transferred from the zone for consumption and potentially at a lower rate than the semi-manufactured item when imported.

There are several proven and legitimate ways to avoid or reduce the additional tariffs the U.S. levies on imported goods.