The Small Business Funding Lunch and Learn, co-hosted by the Rock County Small Business Development Center (SBDC) and SENB Bank on April 27 at Blackhawk Technical College in Janesville, was a great opportunity for entrepreneurs to discover resources and get answers to common financial questions.

Kathryn Jackson, an SBDC small business consultant, kicked off the event, letting the participants know about the Capital Access Clinic and the Digital Marketing Clinic. She informed guests about various classes and consulting services offered by the SBDC as well as funding opportunities currently available in the local area.

Allen Brewer, who has worked as a commercial lender at SENB Bank for more than 20 years, gave some background information on the bank’s history and organization. He inspired the crowd of small business owners, saying “Believe in yourself, follow the recipe and you can get there.” He advised entrepreneurs to “seek out resources, stick to it and believe in your ideas.”

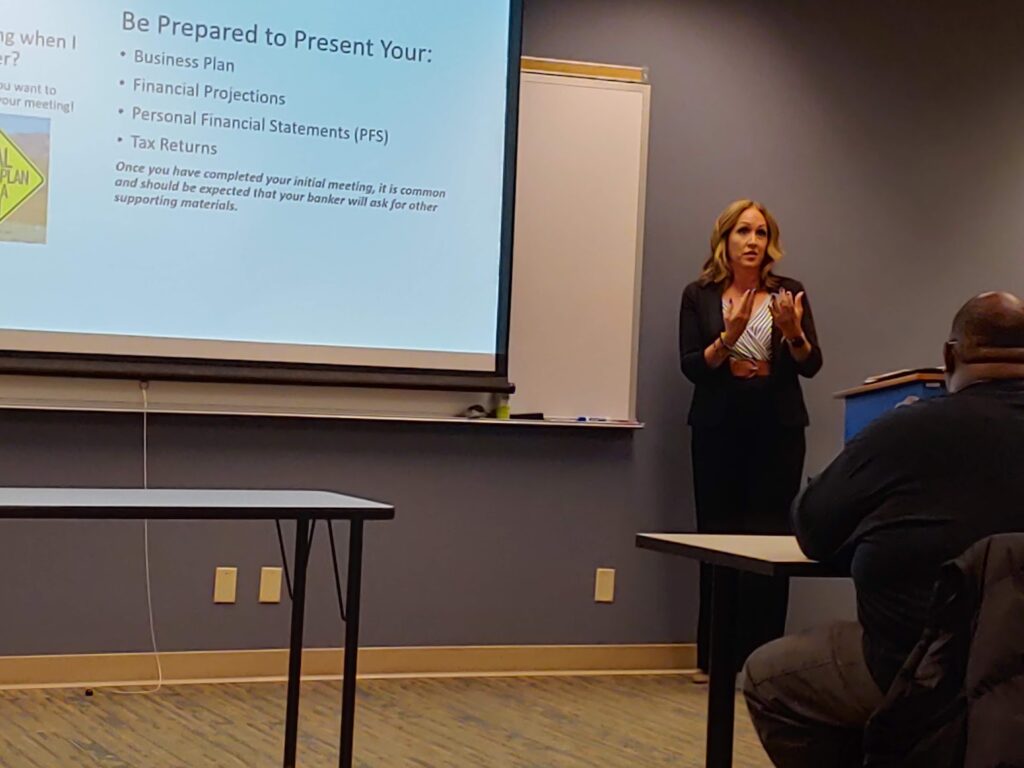

Michelle Matthys, also a commercial lender at SENB Bank, first spoke to attendees about needs small business owners should consider like articles of organization, bylaws, insurance coverage and more. She gave valuable details on financing options, helping the group to understand the difference between lines of credit, loans, credit cards and leases.

Michelle also helped the entrepreneurs understand the 5 Cs of credit: character, capacity, conditions, capital and collateral. She advised the group to prepare a business plan, financial projections, personal financial statements and tax returns to present to banks when trying to obtain funding.

The eager group asked insightful questions to learn more about how past bankruptcies can affect lending, about how personal and business taxes are different and about how to know what makes a bank a good fit for a borrower. The panel answered questions about interest rates, business growth and succession planning as well.

“Access to capital is one of the largest challenges for small business owners. One of my goals is to bridge the gap in Rock County between the small business community and the financial community,” Kathryn Jackson said. “I’m grateful for the team at SENB Bank who shared their time and expertise. While we know bank financing isn’t always a good fit for every entrepreneur, I want business owners to be more knowledgeable about the funding process. This workshop helped accomplish that!”

Highlights from this event included:

5 C’s of Credit:

- Character – What does your business stand for? What do you stand for?

- Capacity – Where is the money? Is your business viable to take the next step?

- Conditions – How are things evolving? Will they impact you?

- Capital – What do you inject into a business to get it started?

- Collateral – How will you pay the loan back?

Be Prepared to Present:

- Business Plan

- Financial Projections

- Personal Financial Statements (PFS)

- Tax Returns